With the passage of the 2017 tax reform law, commonly referred to as the Tax Cuts and Jobs Act (TCJA), the alternative minimum tax (AMT) remains in place for individuals, including those who have ownership in S corporations or partnerships. For C corporations, AMT is repealed beginning in 2018.

With the passage of the 2017 tax reform law, commonly referred to as the Tax Cuts and Jobs Act (TCJA), the alternative minimum tax (AMT) remains in place for individuals, including those who have ownership in S corporations or partnerships. For C corporations, AMT is repealed beginning in 2018.

For certain taxpayers paying AMT, the R&D tax credit offers a unique opportunity for individuals or eligible small businesses (ESBs) to reduce AMT and their overall tax liability. ESBs include nonpublicly-traded corporations, partnerships, or sole proprietors with average annual gross receipts over the prior three years of less than $50 million.

Who Can Benefit

For the tax years listed below, the following entity types may use the R&D tax credit to offset AMT.

2017 Tax Year

- Individuals

- ESBs, including pass-through entities and C corporations

2018 Tax Year and Beyond

- Individuals

- ESBs, pass-through entities only

Background

The usability of the R&D tax credit continues to change. In the past, one of the main limitations on the use of the credit was the AMT, which required companies to pay a minimum federal tax rate, no matter how significant a company’s R&D tax credit.

With the passing of the Protecting Americans from Tax Hikes Act of 2015 (the PATH Act), ESBs were able to use their R&D tax credits to offset AMT for years starting in 2016. Many small to midsize businesses have been able to reduce their AMT because of this change.

The Opportunity for Individuals and ESBs

Individuals or ESBs who are subject to AMT can offset regular taxes and AMT using the R&D tax credit. This opportunity allows a significant portion of an ESB’s R&D credit to be monetized.

Example

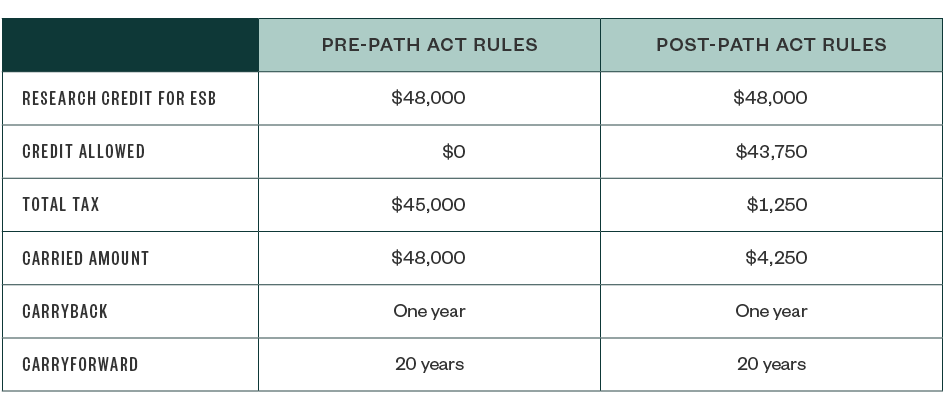

The following is an example of how the R&D credit could potentially benefit individuals and individuals who have ownership ESBs. In the example, the taxpayer saved an additional $43,750 in taxes by properly claiming the credit.

R&D Tax Credit Eligibility

Individuals and ESBs can apply the R&D credit against AMT. But who’s eligible for the R&D tax credit?

Individuals and businesses across industries can qualify for the R&D credit—often for activities they’re already performing. This can include creating products that are lighter, faster, and less expensive, or more durable, reliable, or precise.

In addition to the development of products, the credit includes certain activities for the development of new processes, such as development of new manufacturing lines, automating processes, and increasing production capabilities.

Eligibility Criteria

To be eligible for the credit, an organization’s R&D expenses must be associated with activities that meet each of the following IRS criteria:

- Uncertainty—An organization must demonstrate that it attempted to eliminate uncertainty about the development or improvement of a product or process.

- Process of Experimentation—An organization must also demonstrate—through modeling, simulation, systematic trial and error, or another method—that it evaluated alternatives for achieving the desired result.

- Technological in Nature—The process of experimentation must rely on the hard sciences, such as engineering, physics, chemistry, biology, or computer science.

- Qualified Purpose—The research’s purpose must be to create a new or improved product or process, resulting in increased performance, reliability, or quality.

Qualifying Expenses

Many expenses qualify for the R&D tax credit—as long as a company can substantiate the expenses are directly connected to the R&D it’s performing. Eligible expenses include:

- W-2 taxable wages for employees directly participating in research and development as well as those offering direct support and first-level supervision of the qualified activities.

- Supplies used in research, including extraordinary utilities, prototype equipment, but generally not capital items or general administrative supplies.

- Certain subcontractor expenses, provided the subcontractor’s tasks would qualify if they were being performed by an employee instead. These tasks can include labor, services, or research, but payment can’t be contingent on results. The taxpayer must also retain substantial rights in the results, whether exclusive or shared.

We’re Here to Help

To learn more about the R&D tax credit and how you or your business could potentially benefit, contact your Moss Adams professional or visit our R&D Tax Services page.

You can also become a part of the conversation and stay up-to-date on R&D-related news by joining our R&D Tax Credits Forum on LinkedIn.